Is the restriction now 15000. New Jersey Motor Vehicle Commission.

The Tax Benefits Of Electric Vehicles Saffery Champness

The measure extends the 100 First Year Allowance FYA for businesses purchasing low emission cars for a further 3 years to 31 March 2021.

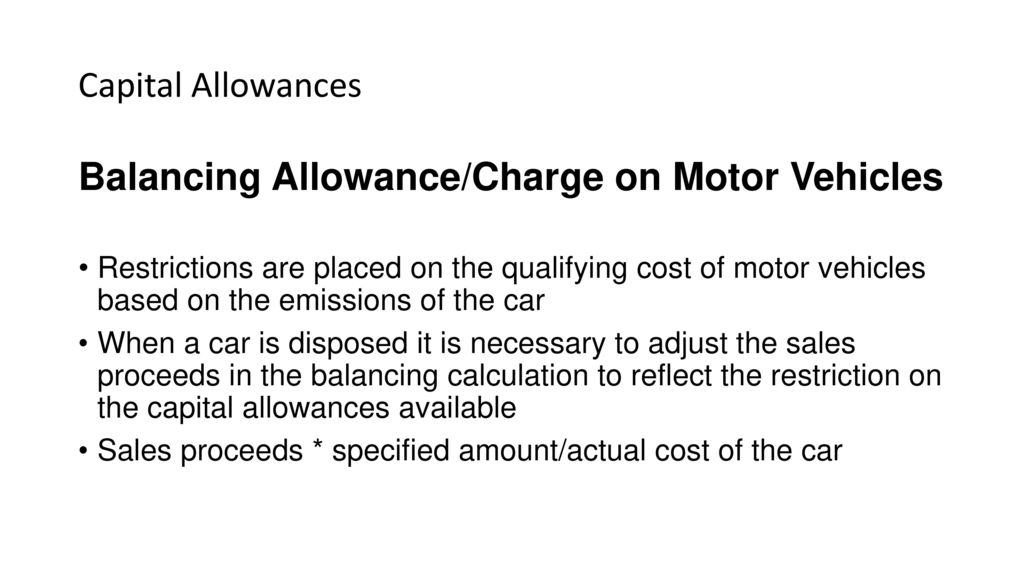

. Of capital allowances and deduction the mechanism of claim for motor vehicles differs. 62015 Date Of Publication. Q-plated and RU-plated cars unless.

I have always believed the correct treatment is to take the cost or bf wdv deduct the 3000 or 25 if lower and carry the. Claim capital allowances so your business pays less tax when you buy assets - equipment fixtures business cars plant and machinery annual investment allowance first year allowances. 27 August 2015 _____ Page 4 of 22 52.

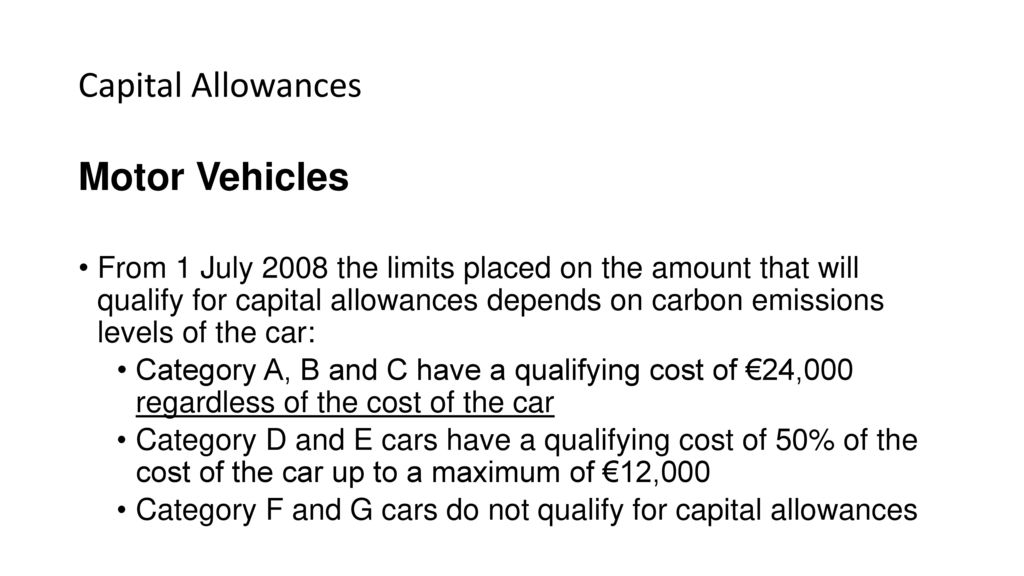

The restrictions on capital allowances and leasing expenses outlined in Tax and Duty Manual Part 11-00-01 apply only in the case of a mechanically propelled road vehicle constructed or. If the motor vehicle qualifies for capital allowance the cost of obtaining the COE may be included when claiming capital allowance on the motor vehicle. Carbon dioxide Emission Level.

Capital allowances cannot be claimed on the costs of private cars eg. Qualifying expenditure for private motor vehicles. Energy efficient equipment.

Notes for Guidance Taxes Consolidation Act 1997 Finance Act 2021 Edition - Part. Motor vehicles which are licensed for commercial transportation of goods or passengers such as lorry truck. Annual Allowance Plant and Machinery.

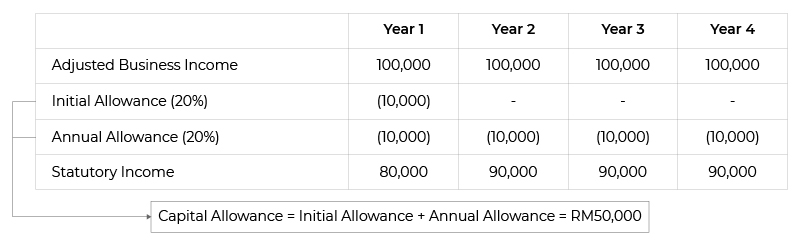

COMPUTATION OF CAPITAL ALLOWANCES Public Ruling No. Qualifying expenditure QE QE includes. We can simplify it by splitting it into 4 categories.

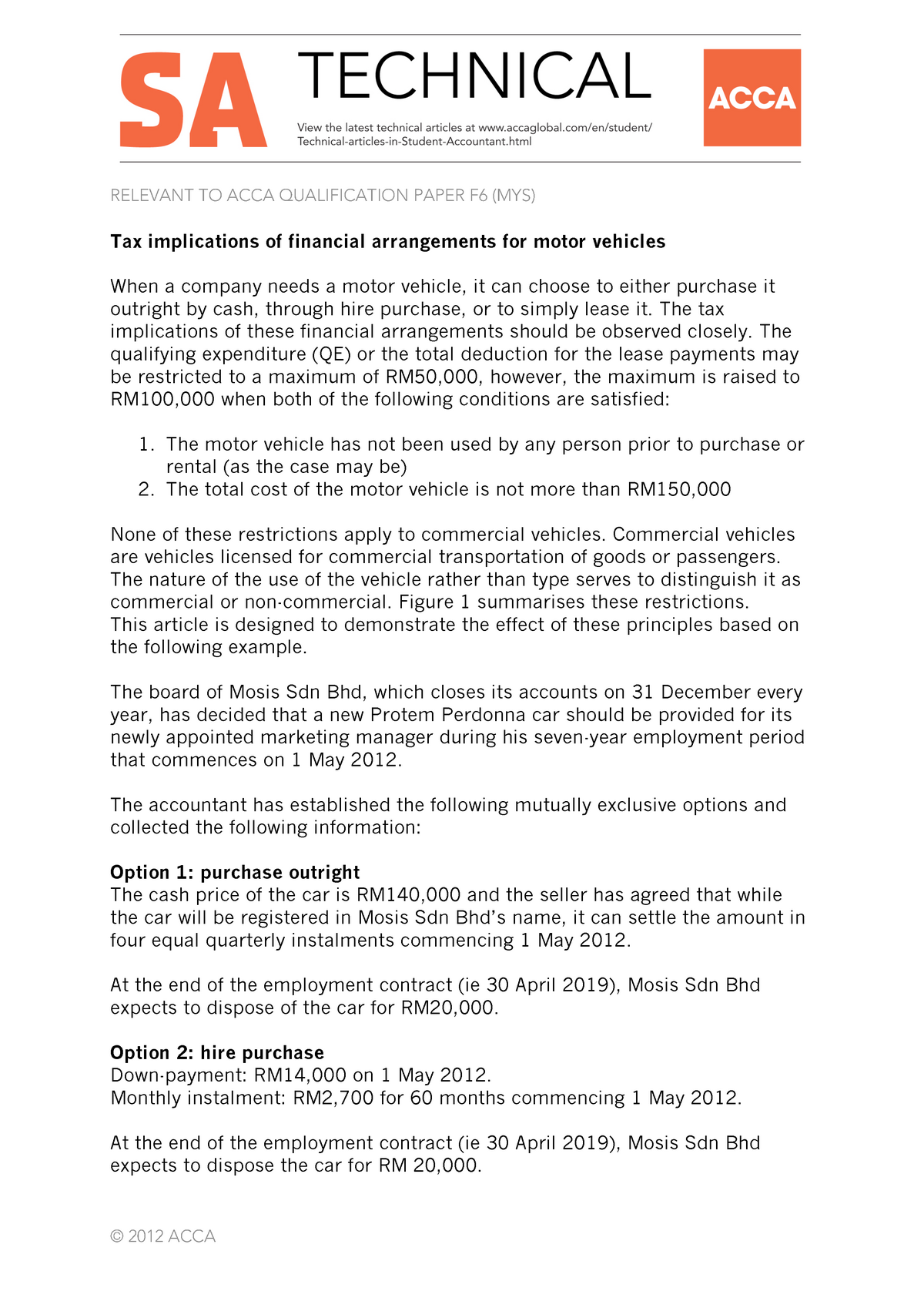

Box 403 Trenton NJ 08666-0403 or telephone that agency at 609 292. The Finance Act 2008 introduced changes and new restrictions to both the calculation of capital allowances and the amount of business leasing expenses allowed for passenger motor cars. Capital allowance is only applicable to business activity and not for individual.

The DMV has ended its extensions for. Capital Allowance restriction - expensive cars. Capital Allowance Claim for Motor Vehicles.

27 August 2015 _____ Page 4 of 22 52 Vehicle a QE for a vehicle licensed for commercial. Qualifying plant expenditure is capital expenditure incurred on the provision of machinery or plant used for the purposes of a business including- 2 In the case of a motor vehicle other than a. Used motor vehicle which cost less than RM50000 the qualifying expenditure is.

- cost of assets used in a business such as plant and machinery office equipment furniture and fittings motor vehicles etc. Any non-driver identification cards and vehicle registrations that were due to expire on March 1 or after. Jim Hooker MVC 609-292-5203.

Company has purchased a car 26000 C02 is 197 gkm Am I correct in thinking that the capital allowance in the 1st year will be restricted to. Vehicles need to be inspected once every two years in New Jersey with the exception of new vehicles. This is due to the accelerated annual allowance rate QE or deduction restrictions deeming provisions.

The official website of the New Jersey Motor Vehicle Commission. S-plated cars and business cars eg. New vehicles need a five.

You may write to the Motor Vehicle Commission Motor Vehicle Commission Customer Advocacy Office PO. Box 160 Trenton NJ Media Contact. Emissions-based limits on capital allowances and expenses for certain road vehicles December 2021.

Vehicle inspections that were due to.

Capital Allowance Calculation Malaysia With Examples Sql Account

Entering The Capital Allowance Details

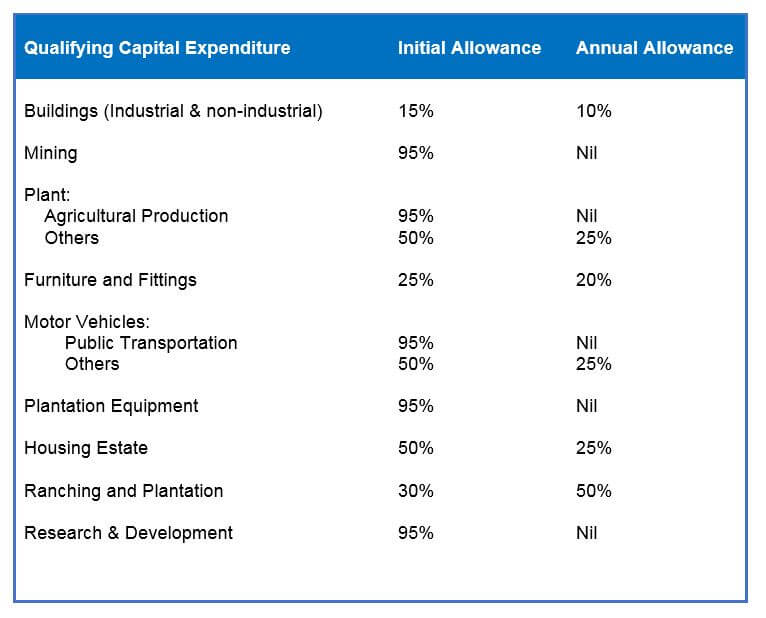

Capital Allowances Relevant To Acca Qualification Paper F6 Mys Tax Implications Of Financial Studocu

Introduction Capital Allowances Depreciation Specifically Disallowed Ppt Download

Capital Allowance In Nigeria Bomes Resources Consulting Brc

Introduction Capital Allowances Depreciation Specifically Disallowed Ppt Download

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

.jpg)

Financing And Leases Tax Treatment Acca Global

What Is Capital Allowance And Industrial Building Allowance How To Claim Them Anc Group

Financing And Leases Tax Treatment Acca Global

.jpg)

Financing And Leases Tax Treatment Acca Global

How To Deal With Private Use In Capital Allowances

How To Deal With Private Use In Capital Allowances

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Introduction Capital Allowances Depreciation Specifically Disallowed Ppt Download

Introduction Capital Allowances Depreciation Specifically Disallowed Ppt Download

Introduction Capital Allowances Depreciation Specifically Disallowed Ppt Download

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global